Hong Kong protestors form human chain across the city. What’s their consensus mechanism? 🤔Source: https://www.cbsnews.com/news/hong-kong-protesters-form-human-chains-across-the-city/

Act I: Why Nations Fail

In 2013, in a World Economic History class that was part of my master’s course, I was introduced to a seminal book called Why Nations Fail. As the name implies, the book attempts to explain the political economy of the world—why some nations and some populations prosper, and others don’t—through the lens of political and economic institutions. It is of course a fool’s errand to summarize any book, let alone one as important and complex as this one, in a few words, but I’ll try anyway.

In a nutshell, the authors argue that the difference between successful nations and failed nations lies in their institutional makeup: in particular, in the difference between inclusive and extractive institutions. Inclusive institutions are those that incentivize citizens to work hard and contribute constructively, secure in the knowledge that they themselves will profit by doing so. By contrast, extractive institutions are those established primarily to extract wealth from one group of people, e.g., the common citizenry, and hand it to another group, e.g., the elites. A nation that exhibits primarily inclusive institutions is more likely to promote broad economic prosperity, whereas one with extractive institutions is doomed to stagnation. After all, the wealth of a nation exists in its people. When this wealth is plundered with impunity by a class of looters without the rule of law or property rights, those people have little incentive to work hard and produce a surplus.

Why Nations Fail is admittedly imperfect. It has an ambitious mandate, and must sometimes paint its narrative in broad strokes. For example, it fails to adequately explore the influence of material factors such as geography, climate, and agriculture. It also fails to explain what gives rise to good institutions in the first place. However, its fundamental argument is cogent and difficult to dispute. Over the years since reading the book, I’ve found that seeing the world through this lens of good institutions versus bad institutions has been especially helpful in understanding why things are the way they are. In particular, it seems clear to me that good, inclusive institutions are indeed a prerequisite for so many of the things we want to see in the world: health, wealth, education, and much else besides.

This institutional lens is becoming even more important as the world becomes more complex and as the pace of change continues to accelerate. The institutions we presently rely on arose in a world that was far different from today’s, so it’s no surprise that they’re increasingly failing to keep up with the new reality. Humanity is in the process of transitioning from the industrial age to a new information age, one defined by software, algorithms, AI, and other powerful technological tools. We will design new institutions to meet the challenges of this new age, utilizing these new tools. However, this is a double-edged sword: while these tools, like those that came before them, will doubtless increase overall productivity and prosperity, they will also increasingly circumscribe human behavior and will severely reduce the role of human agency, discretion, and fallibility. Inevitably, we will delegate more decision-making power to these new institutions and come to rely on them more than we have ever relied on institutions before.

It’s therefore imperative that we internalize the hard-won lesson of what makes for good institutions in the first place: inclusivity. We must design and engineer our institutions in such a way that they include as many humans as possible in cycles of value creation and capture.

“The real problem of humanity is the following: we have paleolithic emotions; medieval institutions; and god-like technology. And it is terrifically dangerous, and it is now approaching a point of crisis overall.” - E. O Wilson

We face unprecedented challenges today as a species. How do we provide jobs for ten billion humans without completely destroying the planet? How can we keep ten billion people happy and safe in an age when technology empowers a single disgruntled individual to cause massively disproportionate levels of misery and destruction?

The institutions at our disposal today are legacy institutions, creatures of a past that was much simpler, smaller, and slower. To be clear, they aren’t completely without merit and we have seen many wins: our world is one that is healthier, richer, and more peaceful than at any point in the past. And yet the existential threats continue to grow. They are the White Walkers, and these legacy institutions are the Wall that will fail to keep them at bay. They have served us well, but they simply aren’t up to the task of coordinating the increasingly intertwined interests of ten billion humans.

To see the failure of legacy institutions in action, we need only look to the growing gap between the rich and the poor, the rise of populism, the global stagnation of democracy, and our utter failure to tackle looming big-picture crises such as climate change. We need fresh thinking, and we need fresh institutions. We need solutions informed by the lessons of the past, but built using powerful new tools and ideas, and designed to scale to a planet of ten billion sovereign individuals, and beyond.

The single biggest failure of the existing system is the collapse of trust. Trust is the lynchpin that undergirds human society. It holds everything together. All of our existing institutions are built on trust. As Nick Szabo points out, these institutions—from private companies, to national banks and the court system, to abstract institutions such as marriage and money—are the tools of social scalability that allow modern human societies of millions or even billions of people to function despite the fact that it’s impossible for all members to know one another on a personal basis. In other words, these institutions allow us to transcend the hardcoded social and cognitive limitations of Dunbar’s number, since we put our trust in those institutions instead of in each other, directly.

But in recent years that trust has begun to erode. We see the collapse of trust all around us, manifest in a myriad of ways: the rise of populism; a resurgent isolationism exemplified in Brexit; ongoing protests in Moscow, Paris, and Hong Kong; the growing frustration with Facebook’s continuous, flagrant violations of its users’ privacy; widespread outrage at bank bailouts and crony capitalism.

We live in an age of questioning authority, of questioning received, canonical sources of knowledge and power. The power dynamic has been flipped upside-down, from surveillance to sousveillance: the watched have become the watchers. Self-sovereign citizen-journalist cypherpunk bloggers hold the government and The Man to account while incumbent empires crumble. These trends by themselves are positive, but taken to the extreme, they have some powerful implications: when no one is in charge, when no one has authority, when no one is trusted, how do we reach consensus on the path forward? Nowhere does anyone seem to have an answer to the increasingly critical question, What comes next? Whither hence, fellow travelers?

Human history is shaped by unstoppable, all-encompassing social and political forces. This was certainly the case in the twentieth century, retrospectively dubbed the fiat century. This is an apt sobriquet indeed, partly due to the end of the gold standard and the rise of fiat money, backed by nothing but the full faith and credit of the modern welfare state. Also, more broadly, due to the emergence of natural economies of scale, an aggregation of power that resulted from The Big Everything: big oil, big companies, big countries, big governments, big fiat money.

In hindsight, this seems like the natural culmination of an industrial revolution. Humans began their evolutionary journey as nomadic hunter-gatherers, which was a naturally decentralized state of affairs. At some point, some of our ancestors abandoned their wandering ways, laying down roots in sedentary villages and perfecting agriculture and animal husbandry. With these new technologies came accumulation of property and wealth. Suddenly, owning more cows or wives or cowrie shells than your neighbor gave you more wealth, power, and influence. Big Men became chiefs; chiefs became kings. Villages grew into towns, which grew into cities, which were consolidated by ambitious kings into vast, sprawling empires.

This progression suggests that humans are hoarders by nature. This cult of the Big, the More, continued to grow. The process began so slowly that it was barely perceptible at first, but 10,000 years later, by the 20th century, the curve tilted ever more steeply towards its logical conclusion, Fukuyama’s End of History: a nation state system that perfectly models a power law distribution, with the lion’s share of wealth, power, and resources in the hands of the tiny few, supported by rampant consumerism and fueled by cheap credit.

Alas, the Great Moderation is over. We’ve reached an inflection point, a Refragmentation, to borrow Paul Graham’s phrase. All extremes are unsustainable, run their course, and eventually, ironically, give rise to their antithesis. Just as the fast food movement has begun to be superseded by a slow food revolution, the age of The Big Everything, of massive economies of scale, is waning and a new age is dawning. Not everything about this new age is visible yet, but one thing is very clear: supersized economies of scale are coming to an end.

Massive, continental armies are losing ground to ragtag bands of flip flop-wearing guerillas. Billion-dollar defense budgets are increasingly given a run for their money by a motley crew of cypherpunks and hackers. Tiny, agile startups that outsource nearly everything run circles around big, slow-moving, vertically-integrated corporations and increasingly outcompete them for talent and capital. Oversized, overfed welfare states are losing competitiveness to clever microstates like Estonia, Malta, and Singapore that, while resource poor, are smarter and better able to respond to the changing times. And these trends are only beginning. Buckle up, buckaroos, because things are about to get a heck of a lot weirder.

The writing is on the wall: we need a new society, with new ways of thinking about and solving the problems that face us, and new tools predicated on this new reality. Less General Motors, more General Mayhem.

The nation state, the largest and most ubiquitous of Szabo’s technologies of social scalability, has run its course. Massive centralization made sense when the only way to protect oneself from bodily harm was to hand an exclusive license on the use of violence to the state. It made sense when, in an era of continental warfare, the only way to secure a nation’s peace and prosperity was to align with one of the global, hegemonic superpowers.

But the wars of the future will not be fought primarily or exclusively using physical violence. In an era of cryptography and strong privacy, the returns to violence will, thankfully, continue to diminish. What, then, comes next?

Act II: Down the rabbit hole

I began my career in 2006 at a hedge fund: a crankshaft in the apparatus by which a wealthy, entrenched global elite extracts an unprecedented amount of wealth from everyday citizens in some of the most parasitic political and economic institutions the world has ever known, grinning derisively all the while and hypocritically pretending to “support Main Street” and have the interests of the common folk at heart. In other words, a textbook example of the prophetically-named “vampire squid.”

For six years, I drank the hegemon’s Kool-Aid. But eventually I woke up to the reality of what was going on around me: the world was, and is, becoming less stable by the day. My work was not only failing to make the world a better place—it was, in fact, making things worse. I did, however, learn one valuable lesson from this experience: money makes the world go ‘round and, try as you might, you cannot hope to change the world without understanding and internalizing this.

Thus disenfranchised, I left the world of high finance to attend business school. There, I launched a startup in healthcare technology, hoping to start a career where I could move the needle for humanity more meaningfully. Over the following three years, I was stomped on, beaten to a pulp, and had every innovative fiber in my body crushed by the lumbering juggernaut of stupidity and tradition that is the “modern” healthcare system of the United States. The experience taught me another vital lesson: innovation is fragile and requires a specific set of circumstances to blossom. I learned that you cannot change the system from within when it’s fundamentally broken, riddled with twisted, perverse incentives.

It took a year-long sabbatical and a journey to the far corners of the earth to reignite my hope in technology and innovation. It was during this time that I first encountered blockchain, in the form of an Ethereum smart contract. I had been aware of Bitcoin for some time, but it had never clicked for me. I hadn’t been prepared to care about topics like privacy or self-sovereign money. Ethereum, however, was another story. There was something magical about the idea of a smart contract that really blew my mind. This is in large part because it’s interdisciplinary by nature, touching as it does upon law, finance, economics, business, sociology, anthropology, and psychology, not to mention of course the enormous engineering effort at the heart of its creation.

The idea of a “decentralized world computer” is one that I had to sit with for days before it began to make sense. I ended my sabbatical early and went home, deep diving into dozens of whitepapers. I met as many people as I could to learn more about this enthralling new technology and what it all meant. My Ethereum journey began in earnest in October 2017, while attending DevCon III in Cancun.

Above all, what excited me about Ethereum, and the concept of a smart contract, was the idea that the hackers shall inherit the earth. This had been a fantasy of mine while growing up lonely with nothing but a computer to keep me company, so to see it materializing was like a childhood dream come true. Finally, we could do away with all those pesky, high-priced, self-important lawyers and paper pushers. Finally, we could build the world we’d always wanted to see entirely in dry code.

The more I began to understand the idea of a DAO, the deeper I fell down the blockchain rabbit hole. The default world began to feel stranger, more distant, more malleable. I became convinced that there was no technology with more appeal and potential than blockchain.

At work here is a deceptively simple yet enticing idea: that we can finally replace the corrupt, broken institutions that plague us. The ones that are a legacy of a bygone era, and that oppress us, implicitly or explicitly, because we simply had no better alternative. At last, we can envision and create a better future built with better, fairer institutions. The neural pathways that Why Nations Fail had imprinted in my brain began to light up and I began to connect the dots: Better institutions. Fairer ones. Written in dry code. Open source. Transparent for all to see, and open to participation by all humans.

To someone with a hacker’s spirit, someone who refuses to blindly accept things the way they are, who is ready, willing, and able to change the world through code, this vision is nothing short of intoxicating.

It all boils down to systems: the incentives underlying them, and the governance that must be used to develop, maintain, and evolve them. If blockchain has given us nothing else, it has given us a fresh appreciation for, and a deeper understanding of just how and why incentives matter so much. But more crucially, it’s given us the tools to build better incentive schemes and, by extension, superior institutions. Moreover, these tools are generally available, accessible, and legible to anyone with the inclination to study them.

In fact, it goes one level deeper. Not only shall the hackers inherit the earth, they must. It’s unclear to me that there is any other demographic on earth with the requisite knowledge, abilities, and ethos. In short, there is no one else I trust to get it right.

The time to act is now, at this critical juncture between the sunset of the old and the dawn of the new. If we fail to deliver, someone else will, and I shudder to think what that might portend for the future of humanity. We face challenges on multiple fronts, from a narrow, backwards-looking, technology-fearing demagoguery and populism on the one hand, to selfish, tech-worshipping Silicon Valley escapism on the other. However, I firmly believe that we have the tools, and we have the opportunity, and we have the optimism and strength to reverse these trends, if we act now. The arc of history is long, but it bends towards decentralization source, and we are at the inflection point.

Where do we stand, and how is it going so far? Let’s take stock.

In 2009, in a watershed moment for the human race, Satoshi introduced Bitcoin to the world. This event was short on fanfare but brimming with deep, subversive meaning and pregnant with possibility. No longer would money, and all the things derived from it—wealth, power, influence—depend upon the state. Any state. In that magic moment, money was decoupled from the sovereignty of the existing order, and we are only just beginning to understand and fully appreciate the significance of this event. Satoshi proved that a small but motivated group of hackers, armed with nothing but their skills, dedication, and values, can fundamentally and irreversibly change the world.

Bitcoin has honeybadgered on since then, reliably churning out one self-sovereign, libertarian, anti-state block every ten minutes. It has evolved, though in an increasingly unambitious fashion, as many feel that it has already achieved its goal. As such, Bitcoin’s de facto governance emphasizes conservativism, continuity, gridlock, and preservation of the status quo—even more than everyone’s favorite example of dysfunctional governance, the federal government of the United States of America.

Ethereum arose in 2015 as a response to this ossification, setting forth a bold new plan: to build a better, more programmable version of money and, indeed, of decentralized computation in general. It has partially delivered on that plan, yet has itself stalled in several critical ways. Most visibly and significantly, its governance has become gridlocked by the exact kinds of roadblocks that Bitcoin’s governance failed to overcome—the very same roadblocks Ethereum was created in response to.

We’ve learned a great deal from the visionaries behind Bitcoin and Ethereum. We inherit their cypherpunk mantle and we stand on the shoulders of giants. We can, must, and will do better.

In response to these and other perceived shortcomings on the part of Bitcoin, Ethereum, and the small number of other live, production blockchain platforms, a new wave of upstart teams are in various stages of building and launching competing platforms. With depressingly few exceptions, they all employ more or less the same bland recipe: sacrifice usability and introduce an untested technology to address scaling, neglect essentials like values and governance, centralize research and development, raise too much money from too few people, issue too many founders’ tokens out of the gate, make a lot of noise and shill yet another shitcoin.

Inevitably, the result is usually a failure to launch, and yet another headstone in the graveyard of good crypto intentions.

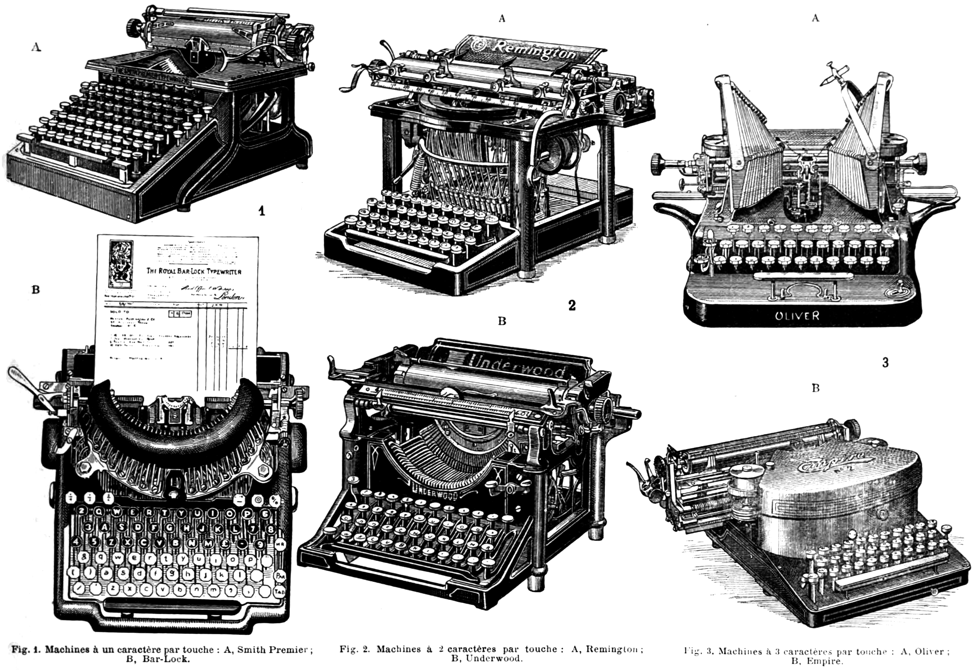

When viewed through the lens of history, all of this is only to be expected. These are the standard growing pains of a new technology. It starts with a genesis moment—an initial early success story. Numerous competitors spring up, smelling money like sharks smell blood, hoping to capitalize on the success of the first mover. They’ll usually tweak one key variable, which triggers a process of evolution by natural selection. The vast majority, perhaps as many as 99%, will fail outright. Some small number will achieve a modicum of success, usually limited to some specific vertical, geographically circumscribed market, or niche use case.

Inevitably, however, a winning model will emerge out of this primordial soup of innovation, usually looking little to nothing like the first mover. We are at peak froth right now, waiting for a Facebook to emerge vis-a-vis Bitcoin’s and Ethereum’s MySpace and Friendster.

The key ingredients to building a better blockchain are only now beginning to become clear. If you squint, you can just make out their shape, hazy and distorted over the horizon. No one has executed on them yet, at least not in a compelling way. But we are getting closer. I’m laying out my version of the story in this article series.

If you ask me, the single most important ingredient is humility, something which has been in short supply of late. Most blockchain projects feel less like revolutionary technology platforms and more like cults of personality. They’re built around a person, an ego, as opposed to any specific ideas, values, or technological innovations. Satoshi was prophetic in many ways, but foreseeing this state of affairs and choosing to remain pseudonymous, and ultimately to disappear at an early stage in Bitcoin’s evolution, was his most prophetic act of all.

It’s essential that, as a community, we have an honest, open, and warm discussion about the values and beliefs that unite us, and about the epoch-making opportunity before us. We must not fall victim to the age-old failure of overestimating what we can achieve in the short term, while underestimating what we can achieve in the long term. But it’s also vital that we’re open about our failings up to this point, and about the things we still don’t know, the things we need help with. This degree of vulnerability and humility will allow us to engage more deeply with a rich community of off-chain thinkers, innovators, scholars, and thought leaders, rather than dismissing them all in the hubristic orgy that has defined so much of the “crypto” space to date.

Act III: Towards a new human chain

Earlier this year, as I emerged from 18 months of heads-down focus on the Ethereum project and community, two other things became immediately clear. The first is that we have lost the forest for the trees—in other words, as a community, we’ve been focused on the wrong things. The second is that, as a result, and in spite of the remarkable opportunity before us, with few exceptions the overall blockchain landscape feels pretty bleak. Fees remain high, usability remains low, and even the most popular blockchain-based apps have appallingly low uptake.

There are many ostensibly exciting blockchain projects in various stages of research and development, but the vast majority give short shrift to emerging best practices. Nearly all projects focus on the same chimera of scalability, and act as if it’s a panacea to all of our woes—nevermind the fact that 99.99% of the humans on the planet have never heard of blockchain, couldn’t care less about it, and/or have a less-than-favorable impression of it.

The right place to start is not scalability, nor is it building tech that seems cool and exciting. That’s putting the cart before the horse. The right place to start is with the human. Who is the user? What is the use case? What sort of macro level social, political, and economic systems do we seek to build, and where and how does blockchain fit in?

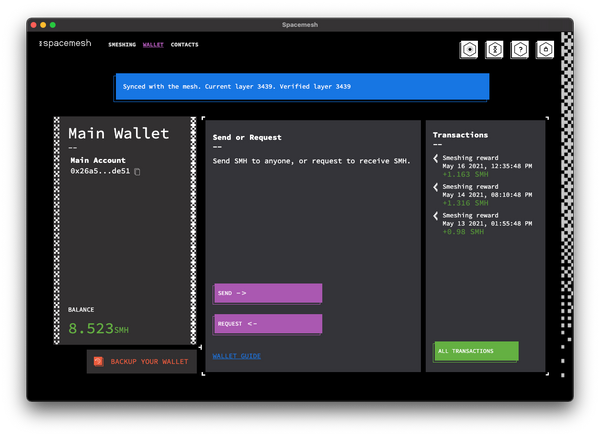

As I sought answers to these questions, one project stood out from among the throng: Spacemesh. In the final part of this article, and with this context in place, I want to explain why I have chosen to devote my time and energy to this worthy project.

Let me begin by admitting that Spacemesh isn’t perfect. It can’t possibly be, since the solution space to the challenges presented by blockchain is vast and largely unexplored. Blockchain is a labyrinth of dilemmas, trilemmas, and wicked, higher-order tradeoffs that we are still in the process of understanding and mapping. I discuss some of these tradeoffs and limitations below (and more in this article series).

However, Spacemesh has chosen a point in this fraught landscape that I believe to be as close as possible to optimal, given our current knowledge and understanding. Even more importantly, it is being built by a team that’s smart, full of humility, and single-mindedly focused on designing and shipping a great piece of software, rather than on making noise.

The first and most important question when designing a new blockchain platform is the choice of consensus mechanism. Others have done a far better job than I can of explaining why proof of work (PoW), the mechanism employed by chains including Bitcoin and Ethereum, is suboptimal, but I’ll do my best to summarize. Proof of work, while relatively simple and elegant, is extraordinarily resource intensive. This means that it requires economies of scale in order to be profitable, leading to massive centralization on the part of miners. This is turn makes it impossible for everyday people to participate in value creation at layer one of these networks.

The next-generation Ethereum network, Serenity, and many other popular blockchain platforms plan to transition to an alternative called proof of stake (PoS). While proof of stake solves the resource consumption problem inherent in proof of work, it has other shortcomings.

For one, it’s not strictly permissionless, since it requires an existing validator to sell you stake and a validation slot. This gives rise to the possibility of the network being captured forever by an invisible, colluding majority of validators. Secondly, its security model is subjective and recursive, since the security of a PoS network relies upon its native token having value, which in turn relies upon a secure network. Third, and perhaps most importantly, it still requires a clumsy, expensive, error-prone onramp process: how does a fifteen-year-old, keen to add value to the network and participate in value creation, get her hands on her first $1,000-10,000 worth of ETH to begin staking? In these ways, PoS-based networks fail to deliver on the promise of a permissionless, decentralized value-creation network.

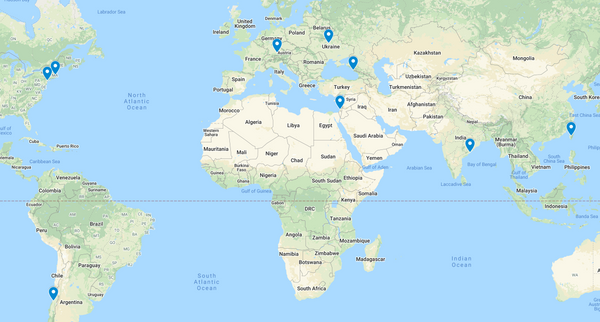

Spacemesh has a different vision, one that’s far truer to the Satoshi ethos: that any human, anywhere in the world, can create and capture value. All they need is access to the Internet and a consumer-grade computer. Download, install, run the mining software and bam! You’re good to go. No permission needed.

Let me say that again, to re-emphasize this point, because it’s the single most important part of Spacemesh: Any human. Anywhere. A computer, and internet. That’s it. No permission, no banks, no KYC, no staking tokens. Instantaneous, permissionless value creation.

It is such a deceptively simple idea. And yet it’s been ignored by every other blockchain project since Bitcoin that I’m familiar with.

Spacemesh achieves this fantastic property thanks to a novel consensus mechanism known as Proof of Space-time (PoST). The details of the protocol are complex and beyond the scope of this article. (Indeed, the biggest downside to Spacemesh is the complexity of its protocol, which is an order of magnitude more complex than Ethereum.) But, in a nutshell, PoST replaces the specialized mining hardware required by PoW, and the hard-to-acquire stake required by PoS, with the simple requirement that a miner fill a portion of their hard drive with cryptographic junk for some period of time: an amount of space, allocated for a period of time, thus, proof of spacetime. If you own a consumer-grade computer, chances are you have a few dozen gigabytes of free space. Spacemesh enables you to put that free space to work immediately, helping to secure the Spacemesh blockchain and earning tokens in exchange.

What’s more, PoST is naturally resistant to the economies of scale that lead to enormous centralization of mining in PoW networks. Likewise with the concentration of staking and validation in PoS networks. No matter how much money the whales sink into Spacemesh mining farms, their marginal cost will always be greater than zero, whereas your marginal cost as an individual miner, with pre-existing hardware, will always be zero (or, more precisely, the opportunity cost associated with a few gigabytes of storage). For this reason, individual miners cannot be priced out of the market the way they inevitably will be in other networks.

Another nice property of the protocol is its race free nature: the fact that all eligible miners get to produce a block at every epoch. Indeed, this is why Spacemesh is a mesh as opposed to a chain. This means PoST is inherently scalable: it can already achieve 2-3 orders of magnitude greater throughput than Bitcoin or Ethereum, a figure that will grow as the protocol matures. Most importantly, it can do this without any of the gimmicks used by other protocols, which typically involve sacrificing decentralization in favor of throughput. (Read more about the Spacemesh protocol here.)

The strengths of Spacemesh extend beyond the core protocol. Like Serenity and many other next-generation blockchain platforms, Spacemesh will feature a VM layer that will allow smart contract execution. One of the most important features of the Ethereum 1.0 VM, and indeed the single most important feature that makes it such an attractive platform for developing decentralized finance and other complex applications, is composability: the fact that a new application can seamlessly build on top of an existing application, calling into its code on behalf of an end user in a single transaction, permissionlessly and by design. In this way, blockchain platforms such as Ethereum offer a killer feature missing from Web2 apps: composable, permissionless, censorship-resistant open APIs between applications, even those built by competing teams of developers.

Sharding, the key scaling technology deployed by Serenity and most other next-generation smart contract platforms, fundamentally breaks composability. Each shard is effectively its own, self-contained blockchain with its own namespace and set of applications. When an application deployed to one shard attempts to call into an application on another shard, there’s a great deal of additional complexity: long latency, degraded UX, a lack of atomicity. Many of the same tradeoffs are present in layer two scaling solutions.

Because it has no need for sharding, Spacemesh maintains composability in an elegant fashion. Its VM is built on the fantastic and rapidly-evolving Rust and Wasm ecosystem, and will therefore be a robust, expressive platform for building killer Web3 applications.

I’d be remiss if I didn’t mention two other critical challenges facing blockchain platforms today: governance and usability. No blockchain platform to date has managed to design or deploy a governance system that ensures a fair distribution of wealth and influence, that has enfranchised a large, distributed community of humans, and that enables ongoing, rapid iteration and development of the platform and protocol. Most experimentation in governance today revolves around on chain governance, otherwise known as ‘token voting’—an antidemocratic and plutocratic approach which hearkens back to feudalism.

Nor has any platform yet cracked usability: making it easy for application developers to build and deploy slick, usable applications that stand a chance of going head-to-head with the best centralized Web2 applications from the likes of Facebook and Uber. Many projects are attempting to do this at layer two, i.e., the application layer, using hacks such as meta-transactions. However, I believe that fundamental design decisions baked into the base layer of protocols such as Ethereum, such as gas and probabilistic finality, mean that this challenge won’t be overcome for the foreseeable future.

I don’t want to suggest that Spacemesh has compelling solutions to these evergreen challenges. However, Spacemesh is taking an enormous step in the right direction, approaching such hurdles with broad perspective, honesty, humility and flexibility. We recognize the gravity of these challenges, and we are devoting considerable resources to addressing them. By having an honest conversation about the things we know and the things we do not know, we feel that we stand as good a chance as anyone of cracking these problems. To this end, we’ve sought the insight of outside experts, such as real-world legislators and UX designers, from the get-go.

Look for more on our thinking on these challenges shortly, and please join the conversation! We welcome all voices.

In conclusion, the most important thing that the blockchain community must do is move forward, one step at a time, with equal parts boldness and humility, using the best ideas and technologies at our disposal today. There is no such thing as a perfect blockchain platform, but I believe that Spacemesh is the best project that exists today. I believe that it will achieve its stated goals, and that it most closely and accurately gives life to the values that blockchain stands for. Spacemesh stands the best chance of realizing the full transformative potential of blockchain technology.

We need a decentralized, censorship resistant, permissionless value-creation application platform for all people: a human chain. This platform exists, and it’s called Spacemesh. You can join us in our quest to change the world. Join the testnet. Stop creating value for unaccountable tech giants, and start creating value for yourself. We couldn’t stop you even if we wanted to, by design! Help us build the future. The time is now; the place is here. See you on the other side!